Trusted by more than 12000+ businesses

The job is tough for business owners. Either you’re juggling various online payroll solutions, or you’re stuck with complex tools that are powerful but difficult to use. This means scattered payroll data, poor reporting, and too much time spent working around the software to try to make it “fit.” But it doesn’t have to be that way.

With Checkmark Payroll, all your payroll tools and data are stored and accessed from your desktop. You’ll save valuable time and get all the information you need to process payroll efficiently, increase employee morale, and avoid costly penalties.

Try it Free for 60 Days

Automate payroll and concentrate on growing your business.

Manage payroll yourself and save while doing it.

See Payroll Pricing

Pay employees accurately and on time to increase their productivity.

Deliver error-free paychecks, W-2s, and payroll reports.

Stay in compliance with IRS laws and reporting requirements.

Improve the efficiency of your company and employees.

Try it Free for 60 Days

We are a small business ourselves; we understand small business needs, and payroll processing is in our DNA.

CheckMark Payroll has the ability to serve almost any business segment. We have worked really hard to build the powerful payroll software that can handle anything from basic payroll to complex payroll requirements.

It does not matter what kind of business you have, CheckMark Payroll has all the features you would expect from a high-priced enterprise payroll system.

With 36+ years of experience in the payroll industry and one of the first companies to roll out payroll software in the ’80s, you can trust us to take care of your payroll and taxes.

Try it Free for 60 Days

Rated the best

Thoroughly pleased with your software and support...

I have been using CheckMark Payroll and 1099 Print for over ten years and am so thoroughly pleased with your products and service that I will continue to purchase them. You support the products excellently and I especially like that when there is an update, you release it release it immediately. Thank you for your efforts.

John, Maryland

Wonderful alternative to QuickBooks payroll...

I use Checkmark Payroll. Your software has been a wonderful alternative to Quickbooks payroll. It allows me to save my clients a lot of money and not only is it easy to use, but it allows for importing all the payroll data into Quickbooks. This is again saves time and money.

Julie, Illinois

Excellent

We are always pleased with the ease of use of the CheckMark platform. It is always nice knowing it automatically updates taxes for federal and state, and transferring to our accounting software is a breeze! We are happy with the product.

james, Colorado

Saved us time and money...

Prior to CheckMark our company was outsourcing our payroll, and now we don't have to do that anymore. CheckMark Payroll has saved us time and money by making it so easy for me to create and submit payroll all the while knowing I can trust the taxes withheld for my specific state! Also, the software makes it easy for me to create and submit my quarterly and annual reports.

Kristina, MinnesotaFor over 41 years, CheckMark has been committed to providing the most reliable, user-friendly and cost-effective business solutions to small and medium-sized businesses. CheckMark pioneered Payroll and accounting software for the Mac platform in the 80's. Since then, we have developed cross-platform programs for payroll, accounting, 1099 and 1095.

Recognizing the growing demand for online payroll and the changing landscape of business operations, CheckMark also launched a cloud payroll platform to provide businesses with greater flexibility, accessibility, and efficiency in managing their payroll processes.

Our top priority is to develop high quality business solutions that are simple to use and are priced with the small and medium sized business in mind. We are proud of our achievements and remain committed to providing the most trusted and reliable solutions to run your business.

Try it Free for 60 DaysPayroll taxes are an important part of your business. CheckMark Payroll takes the stress out of tax filing by providing a variety of detailed payroll reports for small business owners at no extra charge. You get access to 40-plus payroll reports that can be viewed on screen, printed, filed and saved as a text or .xls file.

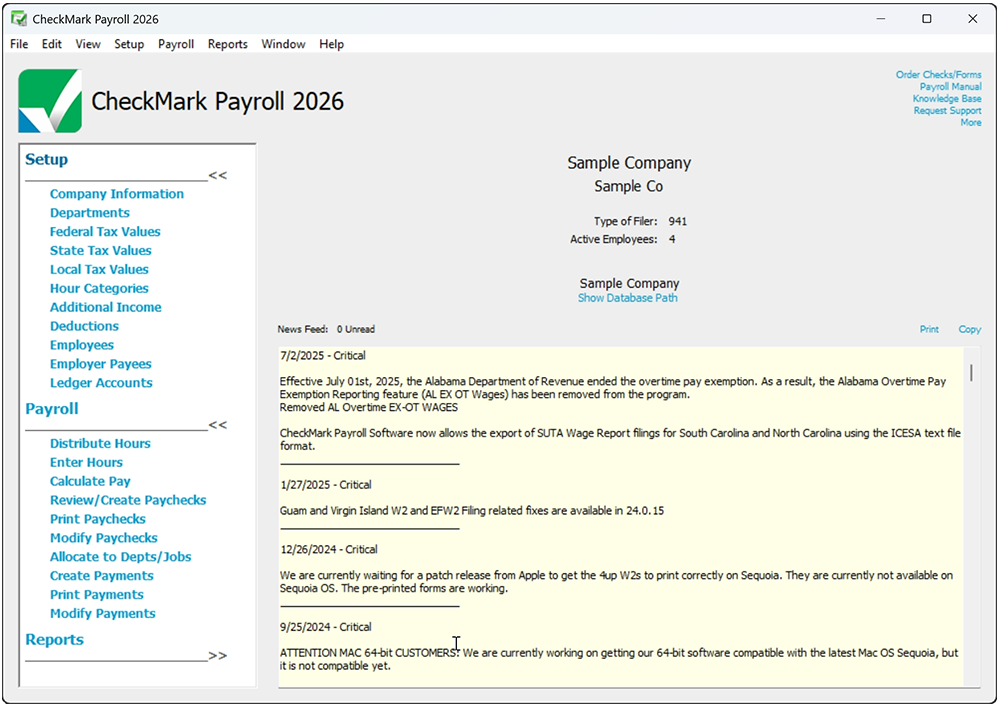

An easy-to-use dashboard giving you quick access to setup, payroll processing, and reporting functions. A News Feed is constantly updated keeping you aware of important payroll changes. Other useful information is listed for quick reference including the number of active employees and where the data is being saved on your computer. Quick links in the upper right-hand corner provide simple, easy access to order paper products, contact support, browse the Knowledge Base, open the Payroll Manual, and much more!

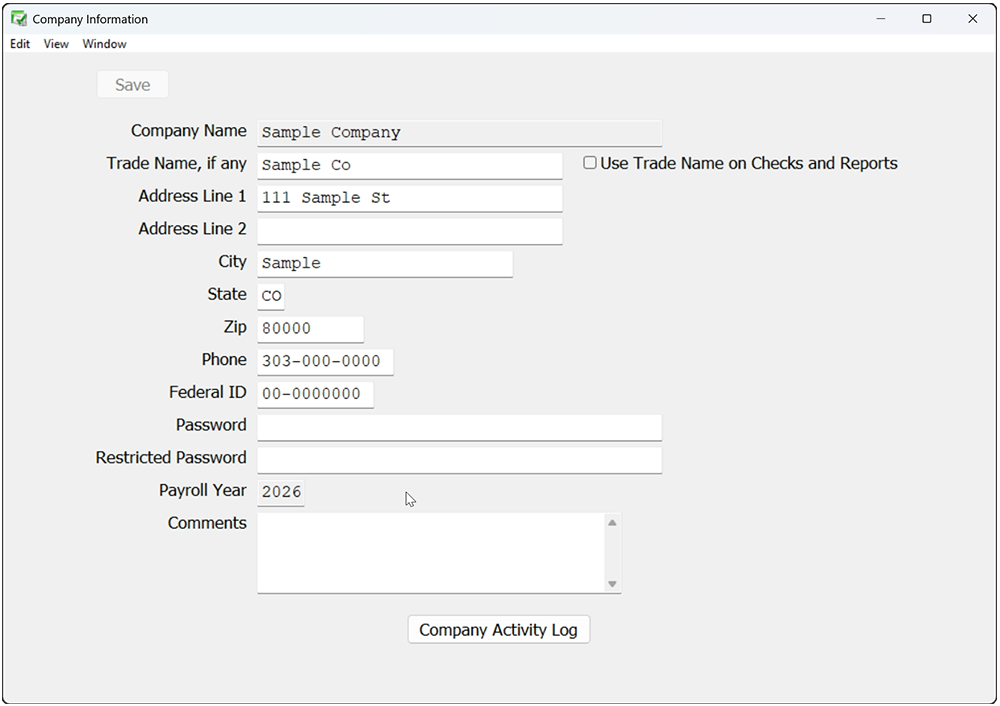

Choose to use a Company or Trade Name to print on checks and reports. Also, an encrypted password keeps information away from prying eyes.

Choose to use a Company or Trade Name to print on checks and reports. Also, an encrypted password keeps information away from prying eyes.

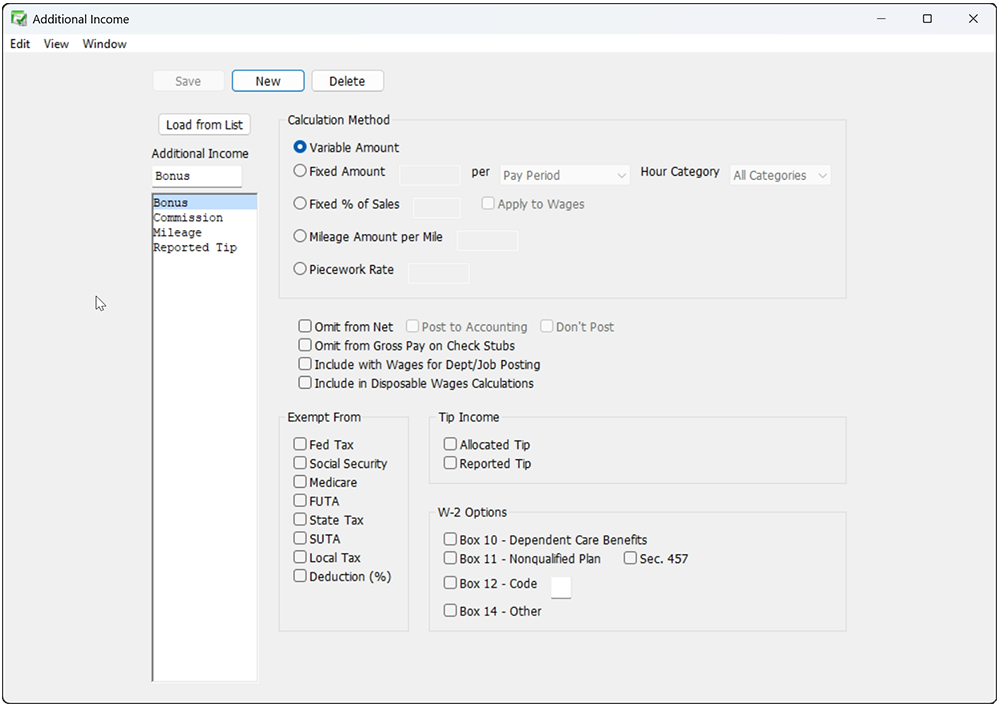

You can set up to 20 Additional Income categories for the company and assign up to 8 per employee. Choose from a list of pre-set categories to use or modify, or create your own.

You can set up to 20 Additional Income categories for the company and assign up to 8 per employee. Choose from a list of pre-set categories to use or modify, or create your own.

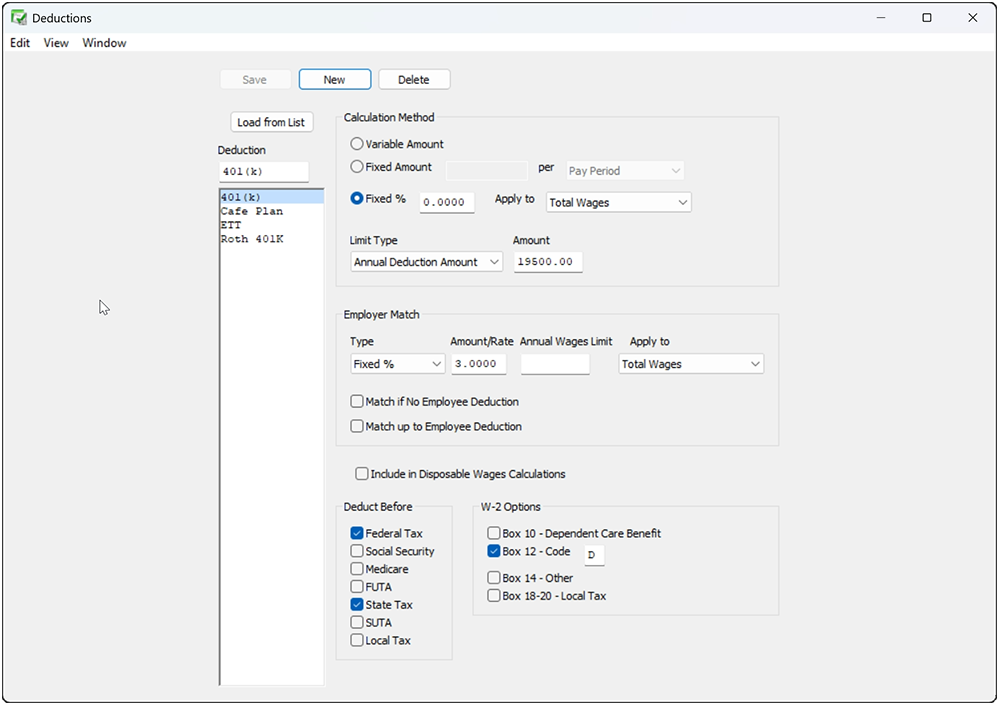

You can set up to 30 Deduction categories for the company and assign up to 16 per employee. You can also set up an Employer Match for categories like a 401(k).

You can set up to 30 Deduction categories for the company and assign up to 16 per employee. You can also set up an Employer Match for categories like a 401(k).

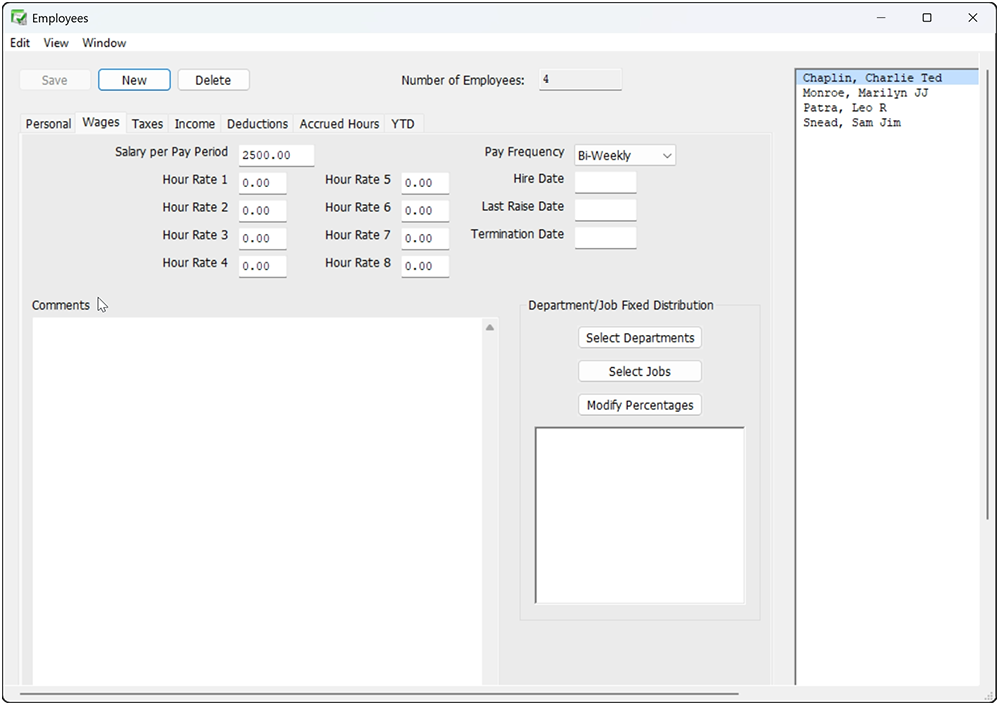

Sort employees by their last name, employee number, or department. Easily separate active or inactive employees, track accrued hours and assign specific Incomes and Deductions for each employee.

Sort employees by their last name, employee number, or department. Easily separate active or inactive employees, track accrued hours and assign specific Incomes and Deductions for each employee.

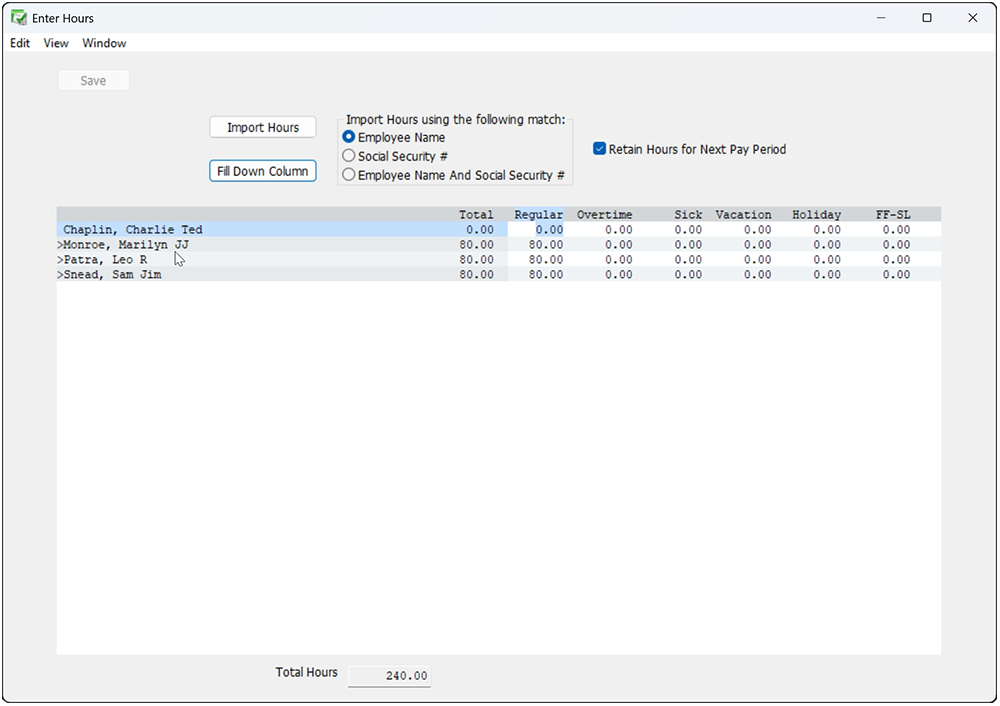

Input hours in an easy-to-follow, spreadsheet-type format or import them from your time and attendance system. Option to sort hourly employees first vs. those set up as salary for easier input.

Input hours in an easy-to-follow, spreadsheet-type format or import them from your time and attendance system. Option to sort hourly employees first vs. those set up as salary for easier input.

Payroll software is a desktop or online payroll solution to manage, maintain and automate employee payments and tax compliance. You can use the software to enroll employees, withhold taxes and deductions, calculate wages, pay employees, file taxes, and maintain payroll records.

Payroll software is used by business owners, employers, HR managers, payroll professionals, and CPAs. No matter your company size, CheckMark Payroll is flexible enough to accommodate basic payroll to complex payroll requirements to streamline the entire life cycle of your payroll operations.

Businesses use payroll software to automate their payroll processes. Some of the benefits of our employee payroll software include:

Yes, we recommend small business owners buy payroll software for automating their payroll operations to save time and avoid costly errors. CheckMark Payroll is designed to make the payroll processes more simpler and accurate. From wage calculation to withholding taxes, our payroll system helps you pay employees accurately and stay compliant with the IRS.

Our software is 100% compliant with the most recent government mandates for the 2026 tax year. The 2026 version includes the latest IRS-approved tax forms, state and federal tax tables, as well as support and software patches released throughout the year, and much more.

CheckMark Payroll of course! Our payroll program offers enterprise-level features to small businesses at a fraction of the cost. It includes high-end features like direct deposit and MICR encoding blank check stock printing. Calculate payroll, print payroll checks, and pay employer taxes in a few minutes. Satisfaction guaranteed!

You can process as many payrolls as you want for all your employees. As your business grows and you start hiring new employees, the payroll costs will always remain the same.

When choosing payroll software for small business, you need to select software that suits your business requirements. Our business payroll software is a simple, flexible, and robust stand-alone payroll software that will grow as your business grows. It has all the features you would expect from a high-priced payroll system.

The cost of payroll software depends on many factors such as employee size, software deployment, and the monthly/annual base fee of payroll vendors. CheckMark Payroll is an affordable in-house payroll system that allows unlimited employees and unlimited payrolls for one flat annual fee. CheckMark offers two payroll plans — CheckMark Payroll Pro and CheckMark Payroll Pro+. There are no extra costs or hidden fees. The base license for CheckMark Payroll software includes one company and one computer. To manage payroll for additional companies or install the software on multiple computers, you’ll need to purchase extra licenses. If you need to manage additional companies, they can be purchased at tiered pricing: $50 each for 2–5 companies, $40 each for 6–15, $30 each for 16–50, and $25 each for 51 or more. To install the software on more computers, you’ll need to purchase it for $99 per additional computer.

See Payroll Pricing

Whether you are a startup or a growing business, our payroll system is robust enough to accommodate any number of employees, be it 2 or 2000, and the cost stays the same.

No, our payroll program is available to companies operating and running their businesses in the USA. But you can use our Canadian cloud payroll solution to process payroll for Canadian employees.

Desktop payroll software designed and built for small businesses

Try it Free for 60 Days