Trusted by more than 12000+ businesses

Managing 1099 tax filing is no small feat. With looming IRS deadlines, the pressure to avoid penalties, and the fear of missing deadlines for sending copies to recipients, it’s easy to feel overwhelmed. Whether you’re handling your own business or managing multiple clients, the task can quickly become a headache.

CheckMark 1099 Software streamlines the entire process, offering a one-stop solution to ensure your 1099 forms are filed accurately with the IRS. Send recipient copies on time, stay fully compliant with the latest IRS regulations, and reduce the stress of tax season. Stay organized and in control, so you can focus on what matters most—growing your business and supporting your clients.

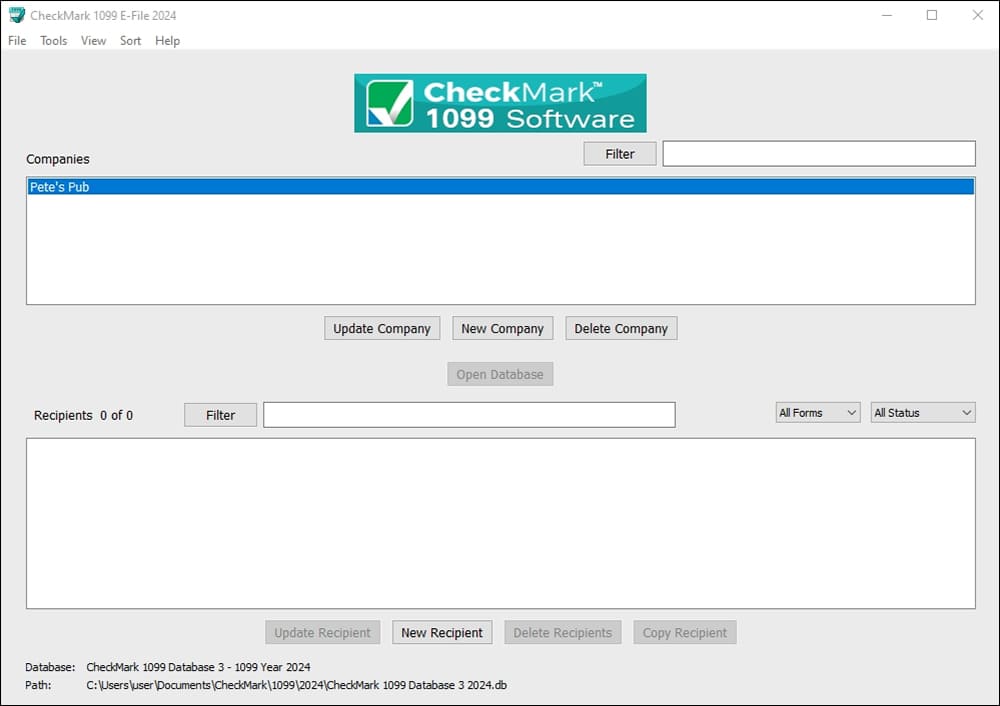

The main screen provides a clear overview of all your companies. By selecting a company, you can easily view and manage a detailed list of recipients, streamlining the 1099 filing process for each entity at a glance.

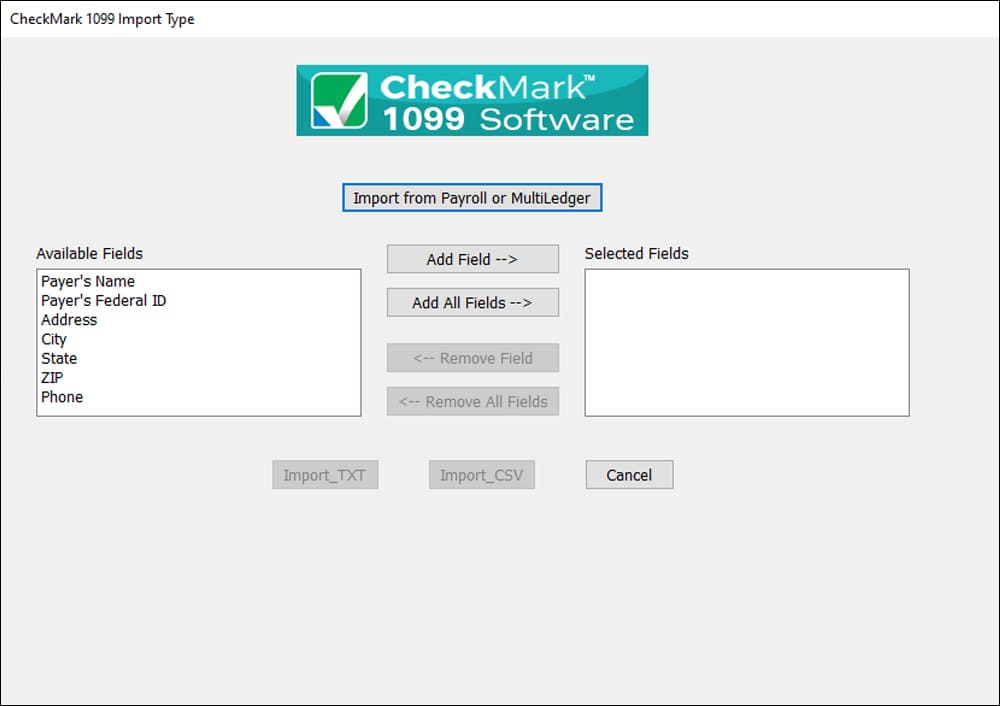

Streamline data entry by importing setup information quickly. Choose the specific fields you wish to import from a tab-delimited text file, or easily integrate data from CheckMark MultiLedger and Payroll Software for even faster processing.

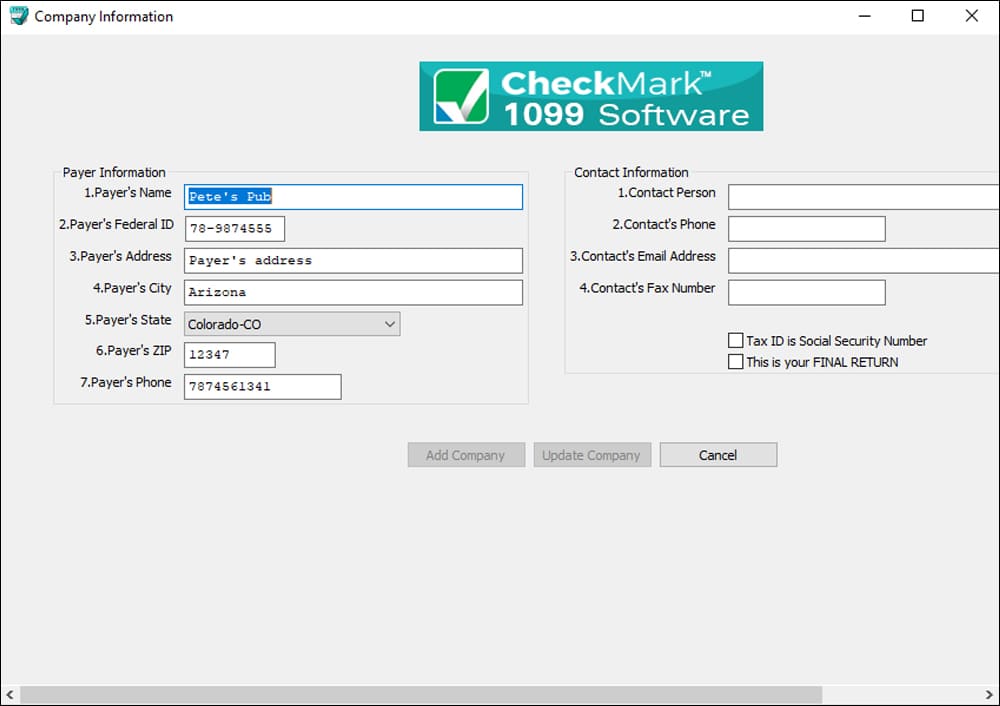

: Easily add new companies into our 1099 filing software with a few simple steps. Use the filter button on the main screen to quickly search for specific companies in your list, and effortlessly update company information as needed to keep everything accurate and up to date.

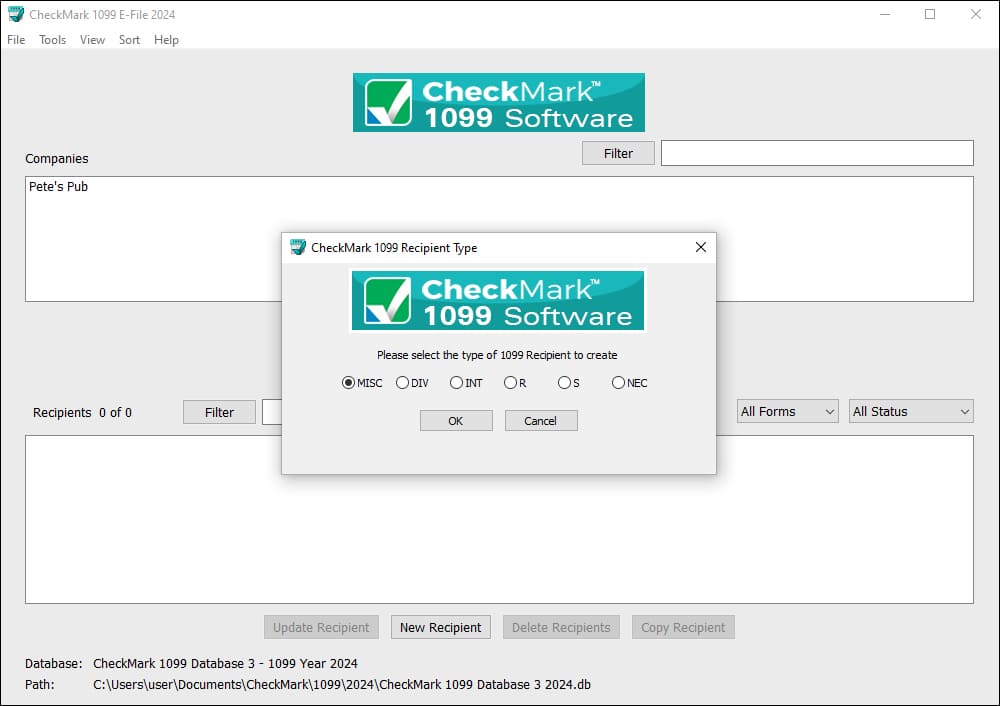

Quickly add or update recipient details based on the recipient type. The intuitive interface allows for easy input of recipient information, and the filter button on the main screen helps you effortlessly search for specific recipients in your list, keeping everything organized.

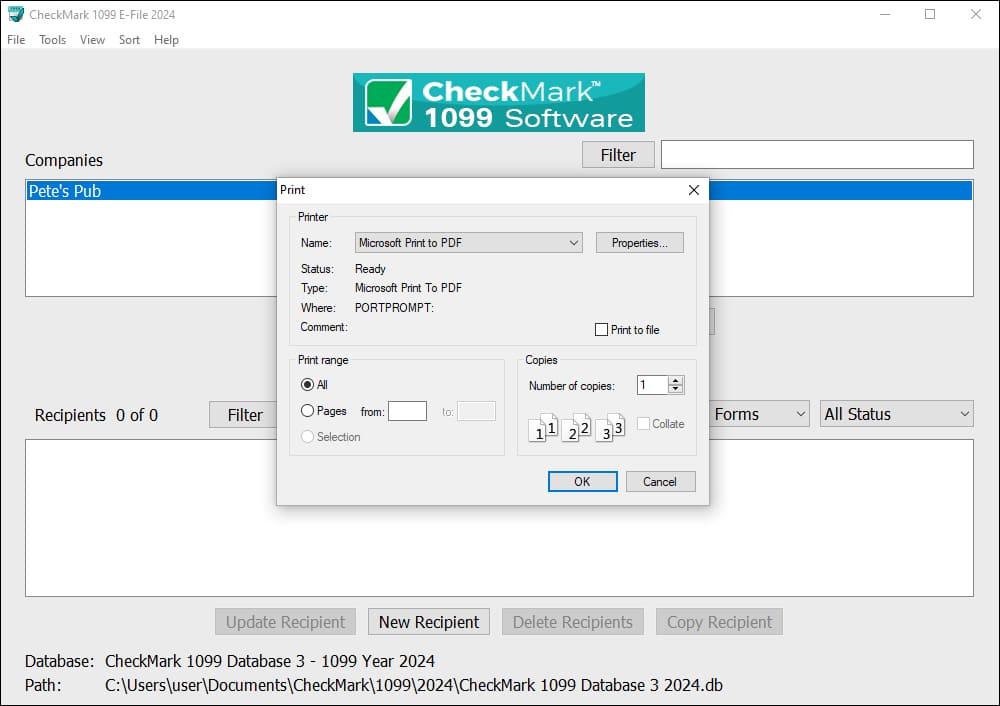

The 1099 Summary Report provides a detailed overview of recipient payments by 1099 type, allowing you to easily compare totals with Box 5 on Form 1096. Use this report to double-check the accuracy of your data before printing, ensuring your filings are precise and error-free.

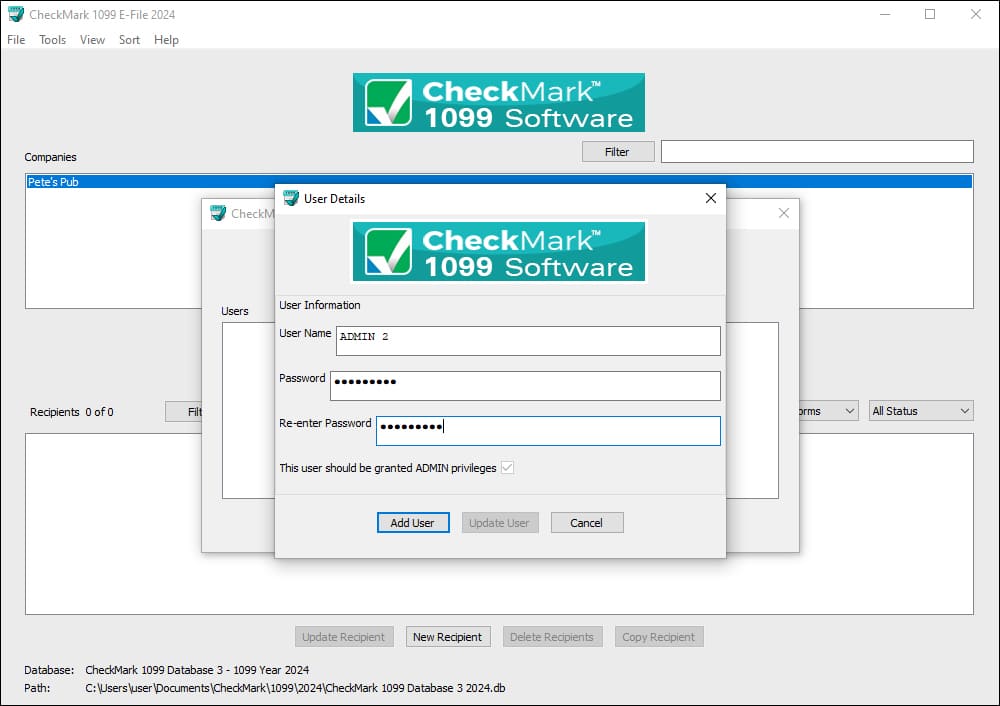

Set up multiple users with unique passwords and control access by assigning full admin privileges or limiting permissions. This feature allows you to manage user roles efficiently, ensuring secure and organized access to your 1099 filing system.

Rated the best

Boost efficiency in your 1099 reporting.

Manage filings yourself and reduce costs.

See 1099 Pricing

Simplify 1099 requirements and focus on growth.

File 1099s on time to steer clear of IRS fines.

Deliver error-free 1099s to recipients and the IRS.

Stay fully compliant with IRS laws and regulations.

To e-file through the FIRE System, you need a FIRE Transmitter Control Code (TCC). Once you receive your FIRE TCC# from the IRS, you can create your FIRE System account. This process should be completed 45-60 days before the filing deadline. For more information, refer to pages 28-36 of Publication 1220 (Part B). Learn More >

Note: Our software exports files in TXT format for the FIRE System. You are responsible for submitting these files to the FIRE System.

CheckMark 1099 Software is designed to meet the needs of virtually every business, from small startups with a few recipients to large enterprises with hundreds or even thousands of contractors. We’ve worked hard to create a powerful and flexible solution that handles everything from standard to complex 1099 requirements.

Whether you're new to 1099 forms or experienced, our user-friendly software offers all the features of high-priced online solutions—without the complexity. It’s intuitive, easy to navigate, and can get you up and running in minutes, regardless of your business’s size or industry.

![]()

![]()

Interface is similar to 1099 forms...

I use CheckMark software for printing Form 1099s to my contractors. The software is easy to figure out when compared to my previous software, which was complicated and stressful. The interface is similar to 1099 forms that make things easier for me while filing. The pricing is affordable. I have looked at a number of different software that allows us to file 1099 online and I didn't find any that offered what CheckMark does at such a reasonable price, for unlimited contractors and unlimited filings. No hidden or surprise fees either.

Denise, Wisconsin![]()

![]()

So much peace of mind during tax season...

I have used CheckMark 1099 software for the past 4 years. I like the software very much and have no problem with the features, functionality and support. It's pretty easy to use with low learning curve. I am able to e-file 1099 to the IRS in a matter of minutes. It allowed me to import information through CSV files from my accounting software. For me, CheckMark has given me so much peace of mind during tax season.

Joseph, California![]()

![]()

Intuitive tax software...

The simplicity of CheckMark 1099 program combined with a straightforward UI makes it an easy and intuitive piece of tax software to use for 1099 filings. The E-Filing process is made easy by integrating with the IRS's FIRE electronic filing system. Importing and exporting information is also hassle free. Ultimately it does what a lot of other products on the market do, however it simply does everything better & comes at budget friendly price.

Scott, Virginia[H]![]()

![]()

Excellent software...

I have been using CheckMark Payroll and 1099 Print for over ten years and am so thoroughly pleased with your products and service that I will continue to purchase them. You support the products excellently and I especially like that when there is an update, you release it immediately. Thank you for your efforts.

John, MarylandFor over 40 years, CheckMark has been dedicated to delivering reliable, user-friendly, and cost-effective solutions to small and medium-sized businesses. As pioneers of payroll and accounting software for the Mac platform in the '80s, we've continually evolved, now offering cross-platform programs for payroll, accounting, 1099, and 1095 reporting.

Our mission is simple: to provide high-quality business solutions that are both easy to use and priced with small and medium-sized businesses in mind. We take pride in our legacy and remain committed to offering trusted, dependable solutions that help your business thrive.

CheckMark offers a one-time, low annual fee that covers everything—no hidden costs. Unlike other companies that nickel and dime you for setup, tech support, additional recipients, printing, or e-filing 1099s, we provide all-inclusive pricing so you know exactly what to expect.

With 40 years of experience in the software industry, our team of 1099 experts has crafted a robust, powerful solution that fits businesses of all sizes. Trust that you're in safe hands with CheckMark's expertise and dedication.

Staying up-to-date with constantly changing 1099 regulations can be challenging. Our team of dedicated professionals ensures you're always in compliance with IRS laws, regulations, and reporting requirements, so you can file with confidence.

CheckMark offers certified 1099 support representatives who are experts in the software and can quickly resolve any questions you may have. Reach us by phone, email, or chat for prompt, reliable assistance.

| 1099 Forms | Due Date to Recipients | Filing to IRS By Mail | E-Filing to IRS |

|---|---|---|---|

| 1099-NEC | January 31 | January 31 | January 31 |

| 1099-MISC (No Data in Boxes 8 or 10) |

January 31 | February 28 | March 31 |

| 1099-MISC (With Data in Boxes 8 or 10) |

February 15 | February 28 | March 31 |

| 1099-S | February 15 | February 28 | March 31 |

| 1099-INT | January 31 | February 28 | March 31 |

| 1099-DIV | January 31 | February 28 | March 31 |

| 1099-R | January 31 | February 28 | March 31 |

Note: If the due date/deadline falls on a Saturday, Sunday, or federal holiday, the filer will need to E-file on the next business day.

When filing 1099-MISC and 1099-INT forms, you can print recipient copies on blank paper. However, the copies you submit to the IRS and state must be printed on pre-printed forms. For 1099-R, 1099-S, and 1099-DIV forms, all copies must be printed on pre-printed forms.

Yes, you can electronically file 1099 forms with the IRS, eliminating the need to print and mail paper copies. Our 1099 Tax Form Software supports only the FIRE System.

The base license of CheckMark 1099 Software includes a single company, single computer installation, and unlimited recipients and filings for a flat annual fee. CheckMark offers two versions: 1099 Print Software and 1099 E-File Software. You can add extra companies for just $30 each and install the software on additional computers for $99 per computer. There are no hidden fees or extra costs.

You can purchase 1099-MISC, -NEC, -INT, -DIV, -R, and -S forms directly from our online store. We offer high-quality forms with fast shipping at affordable rates, ensuring you receive your order quickly and hassle-free.

Yes, CheckMark 1099 Software is fully compatible with the latest versions of both Windows and macOS. It’s the best 1099 software on the market, designed to work flawlessly on both operating systems.

Desktop 1099 software designed and built for small businesses and accountants

Download now - It's free