Trusted by more than 12000+ businesses

Ensuring ACA reporting compliance can be a daunting task for business owners. The pressure to file 1095 forms before deadlines, avoiding IRS penalties, and the concern of timely distribution of forms to the employees can add significant stress during tax season.

With CheckMark 1095 Software, you get a comprehensive solution to accurately file 1095 forms with the IRS, print and send copies to recipients promptly, and remain compliant with evolving ACA laws. This streamlined process can reduce stress during tax season and enhance overall organizational efficiency.

Supported 1095 Form Types

CheckMark 1095 Software is a simple, easy-to-use, and affordable solution for small and medium-sized businesses to report and file ACA (Affordable Care Act) requirements. Available in two versions – E-File or Print – for both Windows® and Mac® platforms.

Our ACA reporting software facilitates accurate reporting and filing of health care coverage provided to employees and the IRS. Featuring multilevel security and controlled access, Our 1095 filing software ensures data integrity and regulatory compliance. Users can file ACA filings for unlimited employees, with options for paper or electronic submission of various 1095 forms to the IRS.

Ensure seamless compliance with 1095 forms, effortlessly managing regulatory requirements.

Identify and rectify compliance issues proactively, preventing regulatory penalties.

Cut down on manual effort, saving time and resources for your business operations.

Secure sensitive employee information with advanced data protection features.

Guarantee accuracy in ACA reporting, eliminating the risk of costly errors.

Generate precise 1095 forms, maintaining absolute accuracy in your reporting.

CheckMark 1095 Software is designed to cater to almost any business segment. Our team has put in considerable effort to create robust and flexible ACA reporting software capable of handling a broad spectrum of ACA requirements, from standard to complex. This means it's suitable for businesses of all sizes and types, ranging from small businesses with just a few employees to large enterprises with hundreds or even thousands of employees.

Regardless of the nature of your business, our 1095 Software encompasses all the features you would expect from a high-priced online ACA reporting solution. Additionally, the software is user-friendly and intuitive. Even if you are not familiar with 1095 forms or have never used this type of software before, you should be able to quickly get up and running within minutes.

Download Demo NowRated the best

![]()

![]()

Best ACA reporting solution in the market...

I have been with CheckMark 1095 Software for over a year now, and I have found it to be the best and simple ACA reporting solution in the market. Even I recommend it to my friend who runs his own business in Seattle.

Thomas, Louisiana![]()

![]()

Intuitive interface and helpful support team...

I use CheckMark 1095 Software for reporting and complying with the Affordable Care Act. It's really easy to use, intuitive interface and helpful support that makes things so much easier for my business! I thank CheckMark for helping me take care of ACA with ease and accuracy.

Joshua, Illinois![]()

![]()

Useful software for 1095 reporting…

I find it very useful for creating the 1095 C forms that we are required to provide to our employees. I do wish there was a little more automation to make the process less time consuming.

Cory , Florida![]()

![]()

Very affordable solution

I recently purchased CheckMark 1095 Software, and I must say it's a very affordable solution that doesn't compromise on features. Highly recommended for businesses looking for a cost-effective and efficient 1095 solution!

Stephen, MarylandFor over 40 years, CheckMark has been committed to providing the most reliable, user-friendly, and cost-effective solutions to small and medium-sized businesses. CheckMark pioneered Payroll and accounting software for the Mac platform in the '80s. Since then, we have developed cross-platform programs for payroll, accounting, 1099 and 1095.

To cater to the growing demand for online software and accommodate the ever-changing business landscape, CheckMark also introduced a cloud payroll platform that equips businesses with enhanced flexibility, accessibility, and efficiency to effectively manage their payroll processes.

Our highest priority is to develop high-quality business solutions that are simple to use and are priced with the small and medium-sized business in mind. We are proud of our achievements and remain committed to providing the most trusted and reliable solutions to run your business.

Download Demo Now

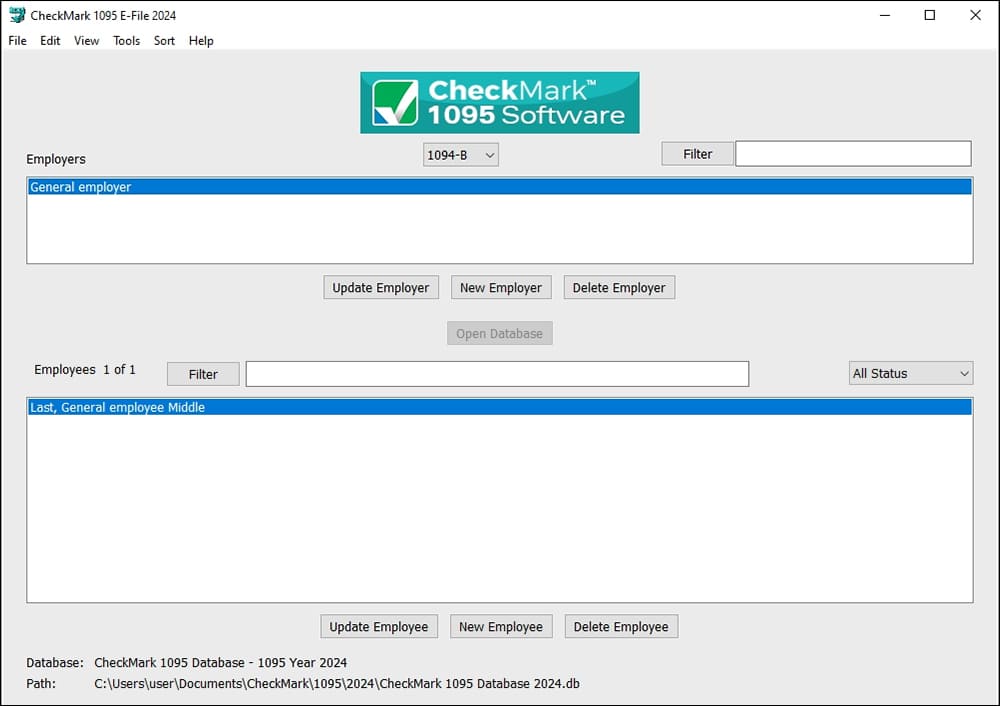

The dashboard displays a list of different companies that are set up. If a specific company is selected, the dashboard also shows a list of recipients associated with that company.

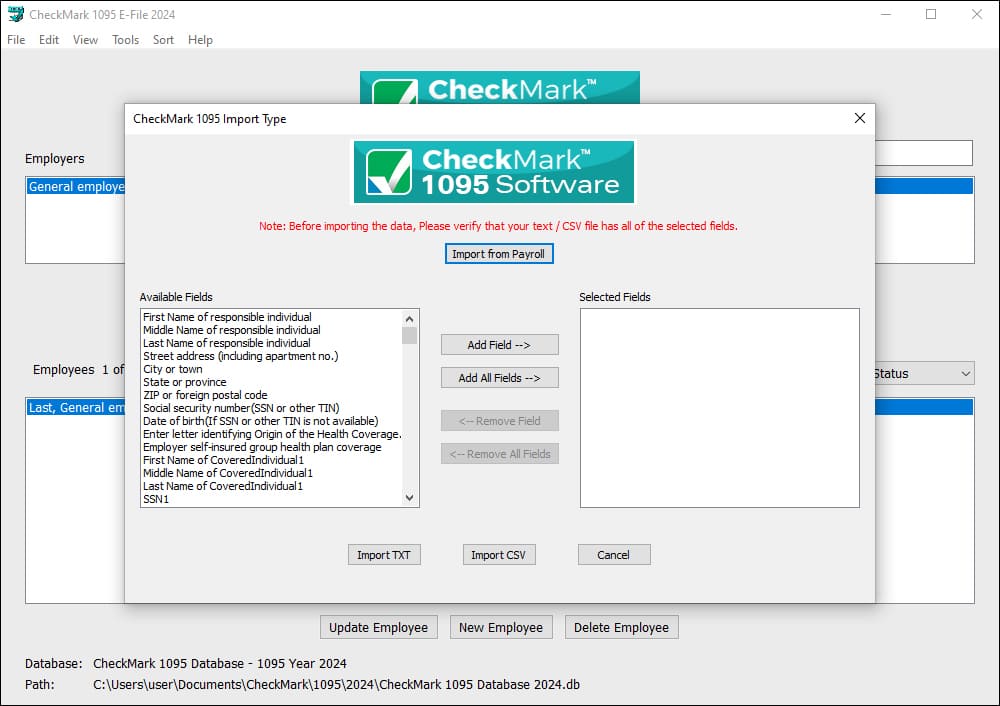

Speed up the setup process by importing information. Select the fields you want to import and bring in data using a tab-delimited text file.

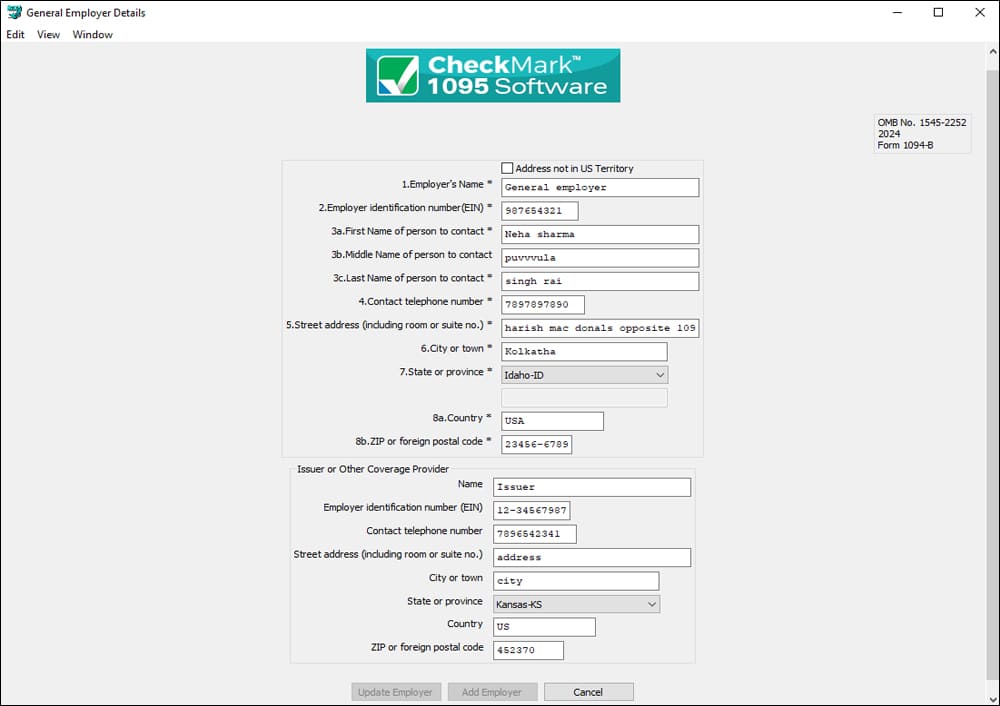

Enter new employer details or update existing information. Utilize the filter button to easily search for specific companies in the list.

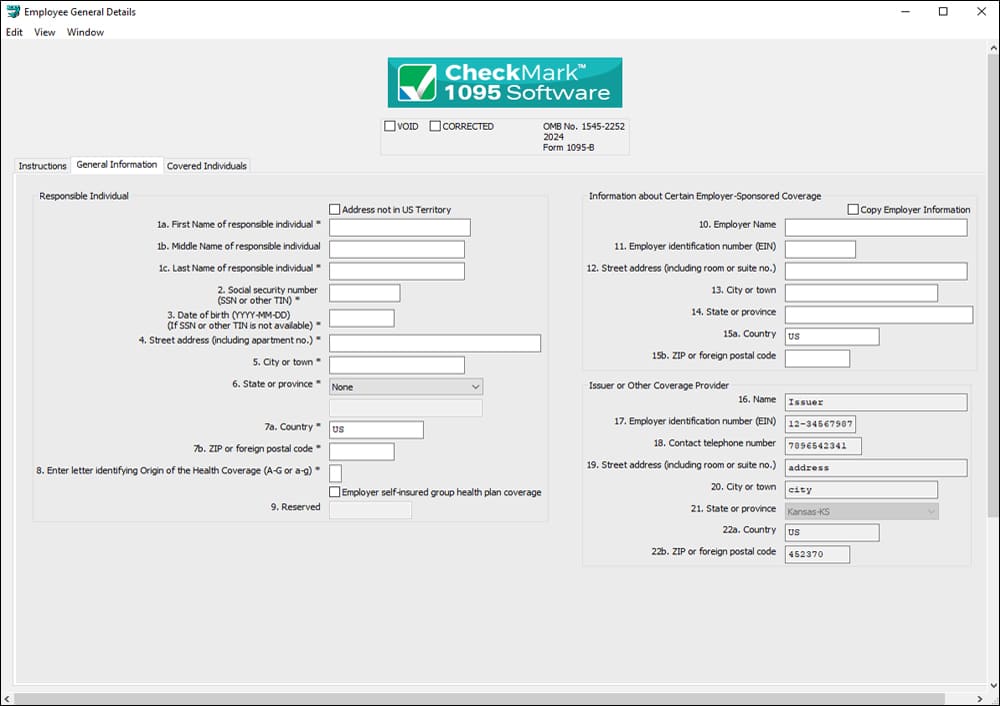

Add or update employees by entering information based on the same fields found on 1095 forms. Use the filter button to easily search for specific employees in the list.

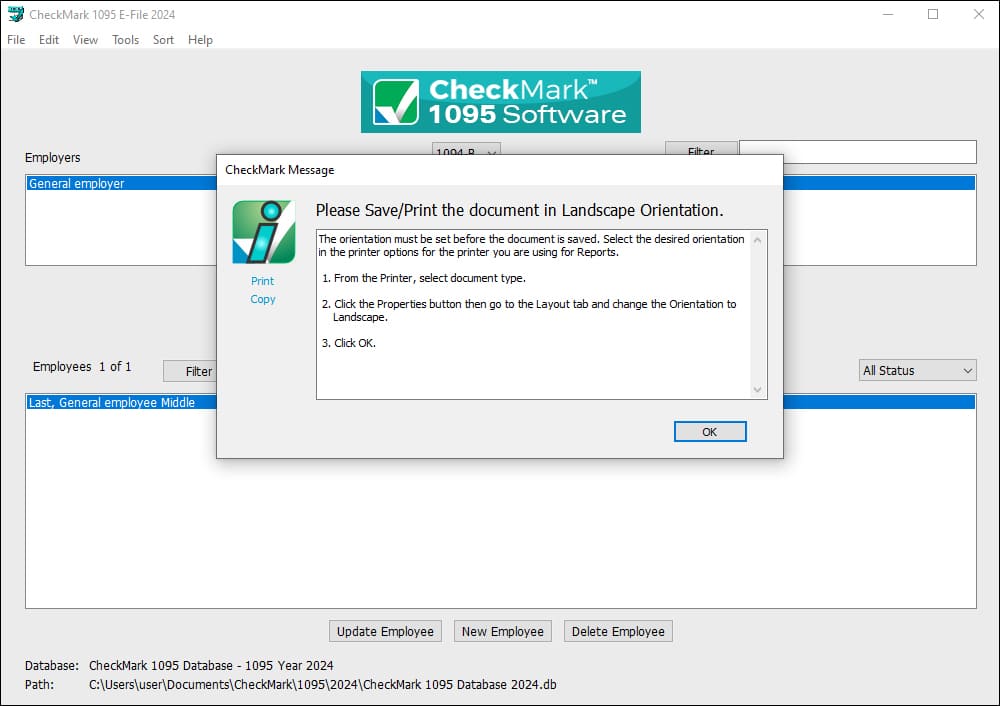

Print forms for both the employer and each employee, along with the form that you will submit to the IRS.

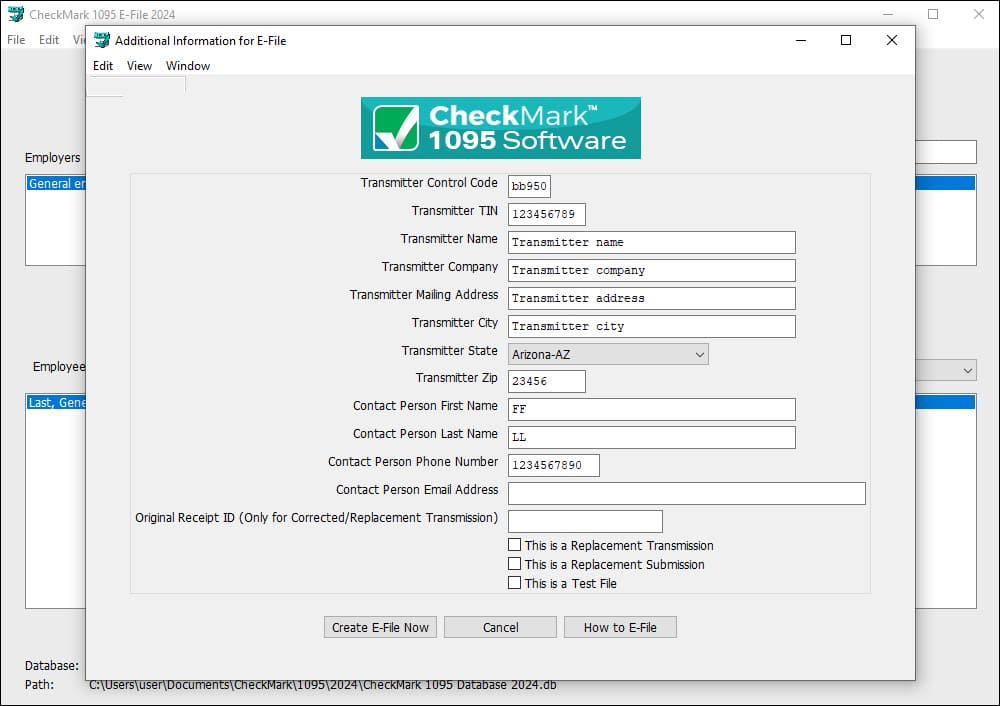

Transmit 1095 forms electronically with the IRS, streamlining the process ensuring accuracy, and reducing the hassle associated with traditional paper filing.

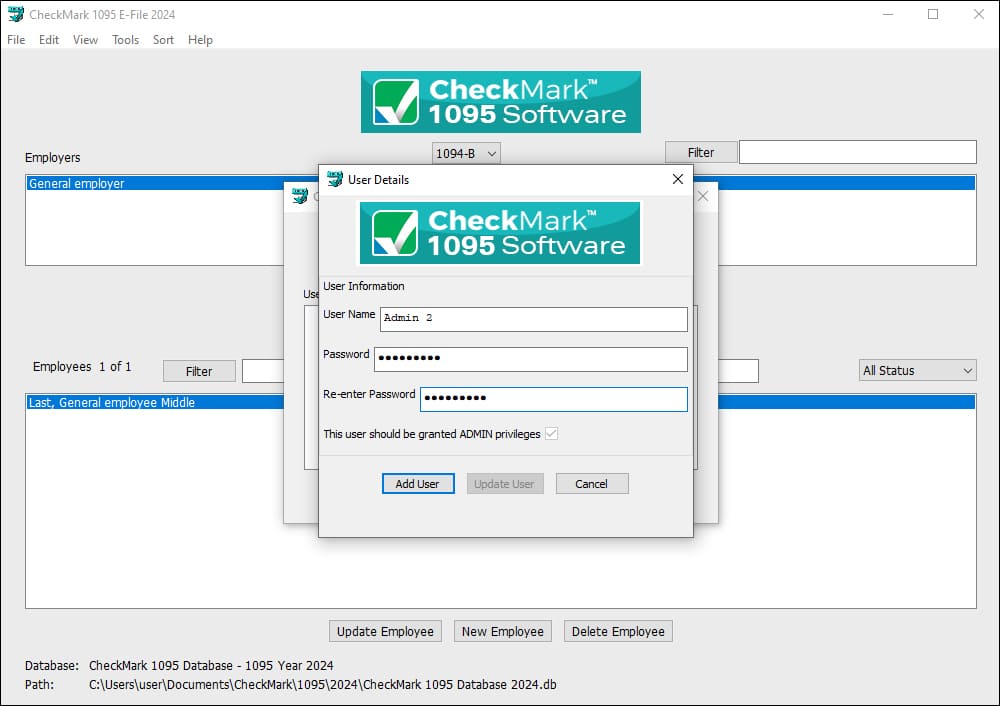

Set up multiple users and passwords, and choose whether those users have full admin privileges or not.

ACA software, or Affordable Care Act software, is a tool specifically designed to help businesses and entities comply with the reporting requirements of the Affordable Care Act. It simplifies the process of generating and filing IRS Forms 1094 and 1095, ensuring accurate reporting of health coverage information for employees.

Any business or entity providing health coverage to employees and obligated to file IRS 1095 Forms should use 1095 Software to meet the Affordable Care Act reporting requirements. CheckMark 1095 Software streamlines the ACA reporting process, saving time and ensuring compliance.

ACA compliance refers to adhering to the regulations outlined in the Affordable Care Act. This involves accurately reporting health coverage information for employees to the IRS using specific forms, such as 1094 and 1095, to avoid penalties.

CheckMark 1095 Software is a valuable tool in meeting this compliance. It facilitates the accurate reporting of health coverage information, reducing the risk of penalties and ensuring overall compliance with ACA regulations.

Indeed, ACA reporting is compulsory for applicable large employers (ALEs) and entities offering minimum essential health coverage. It involves annual reporting of information to both the IRS and employees to fulfill tax reporting requirements, prevent penalties, and ensure continued compliance with the Affordable Care Act.

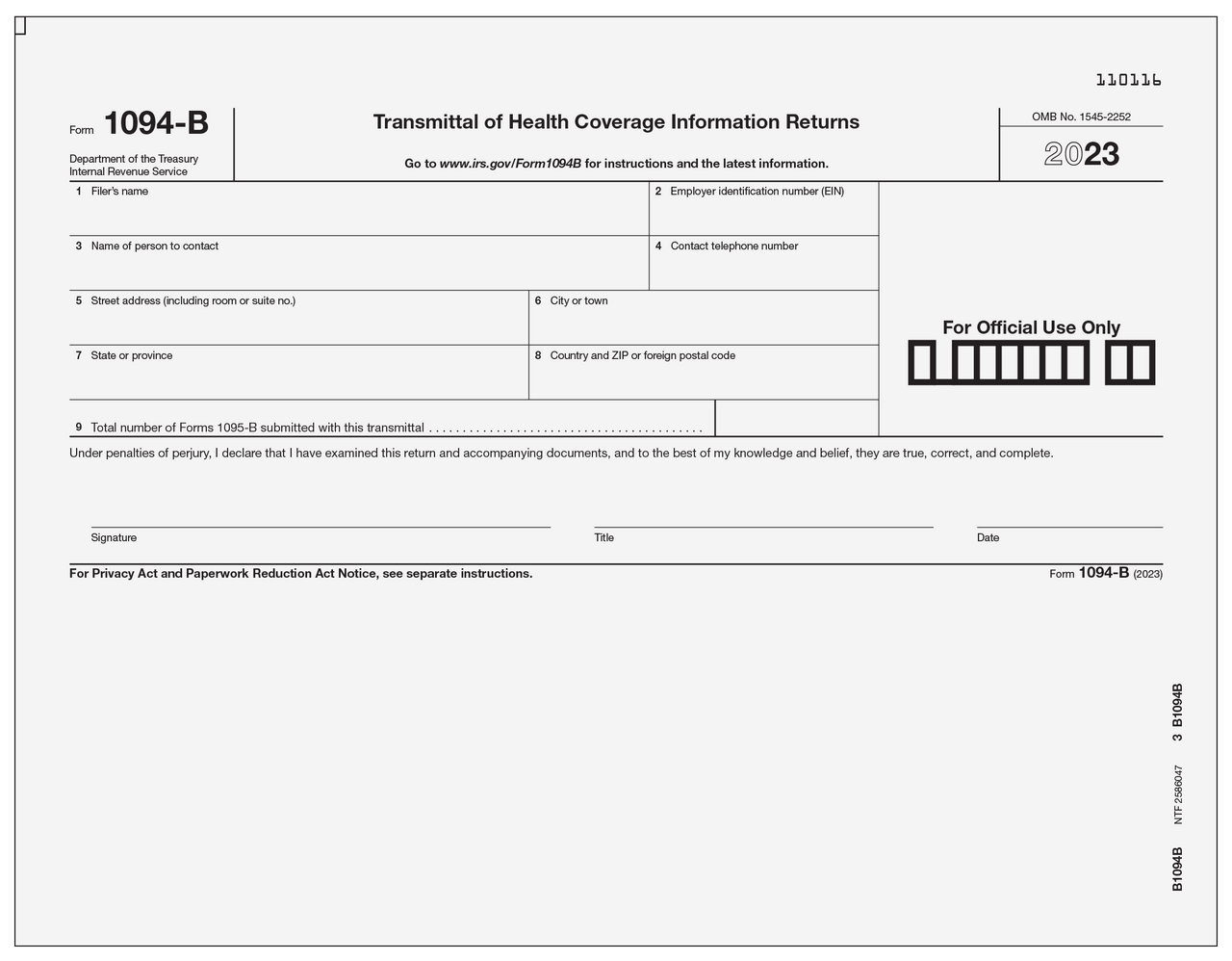

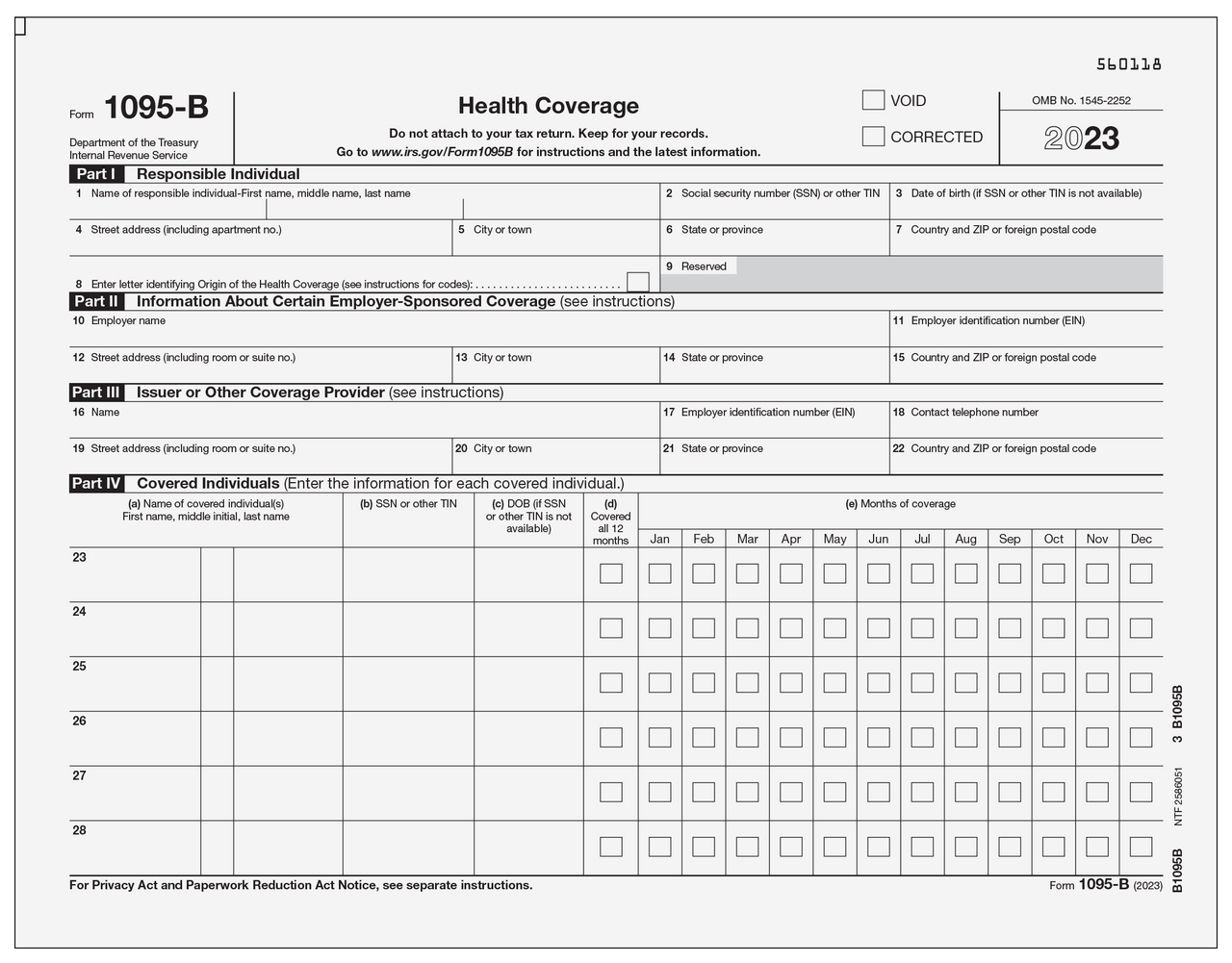

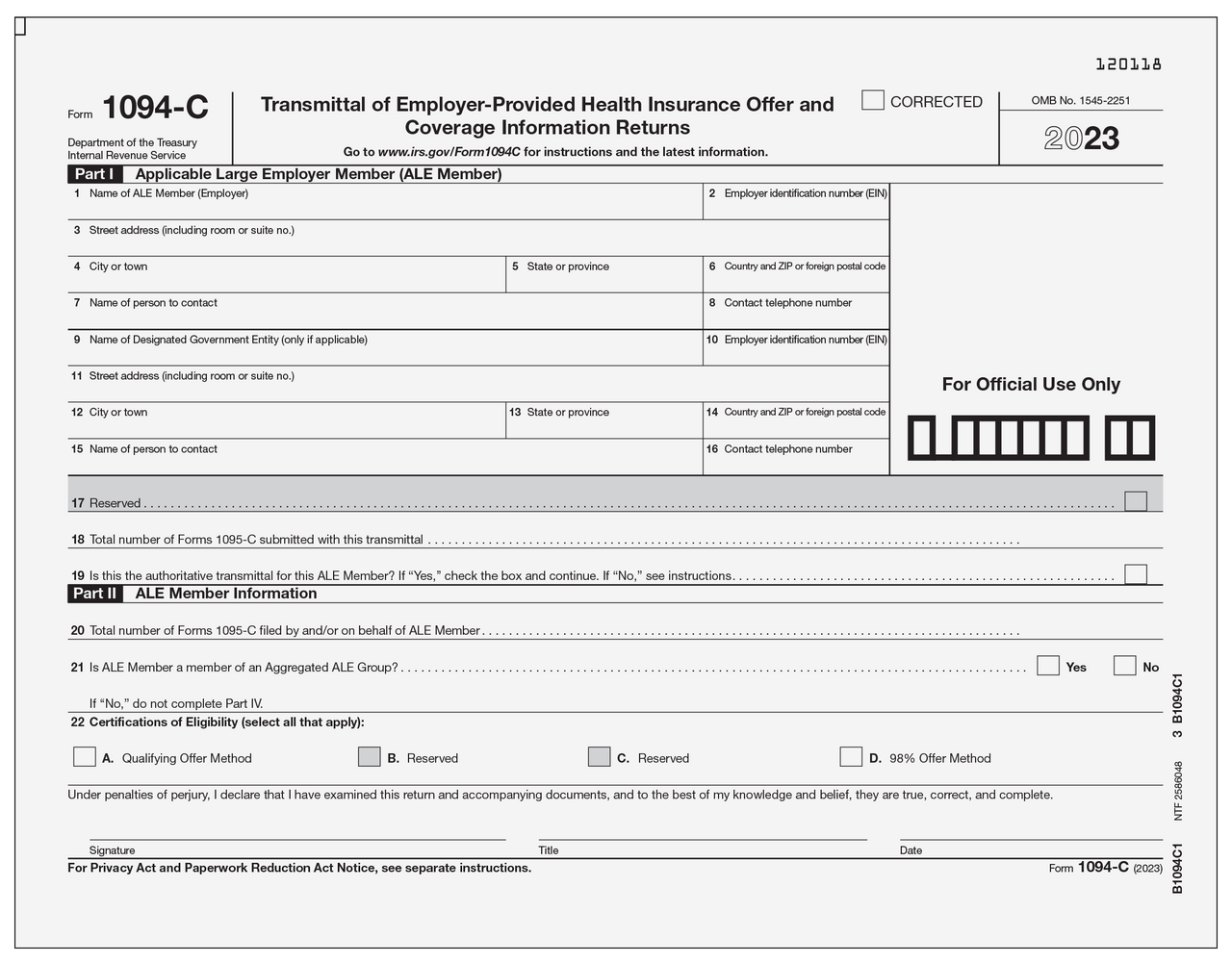

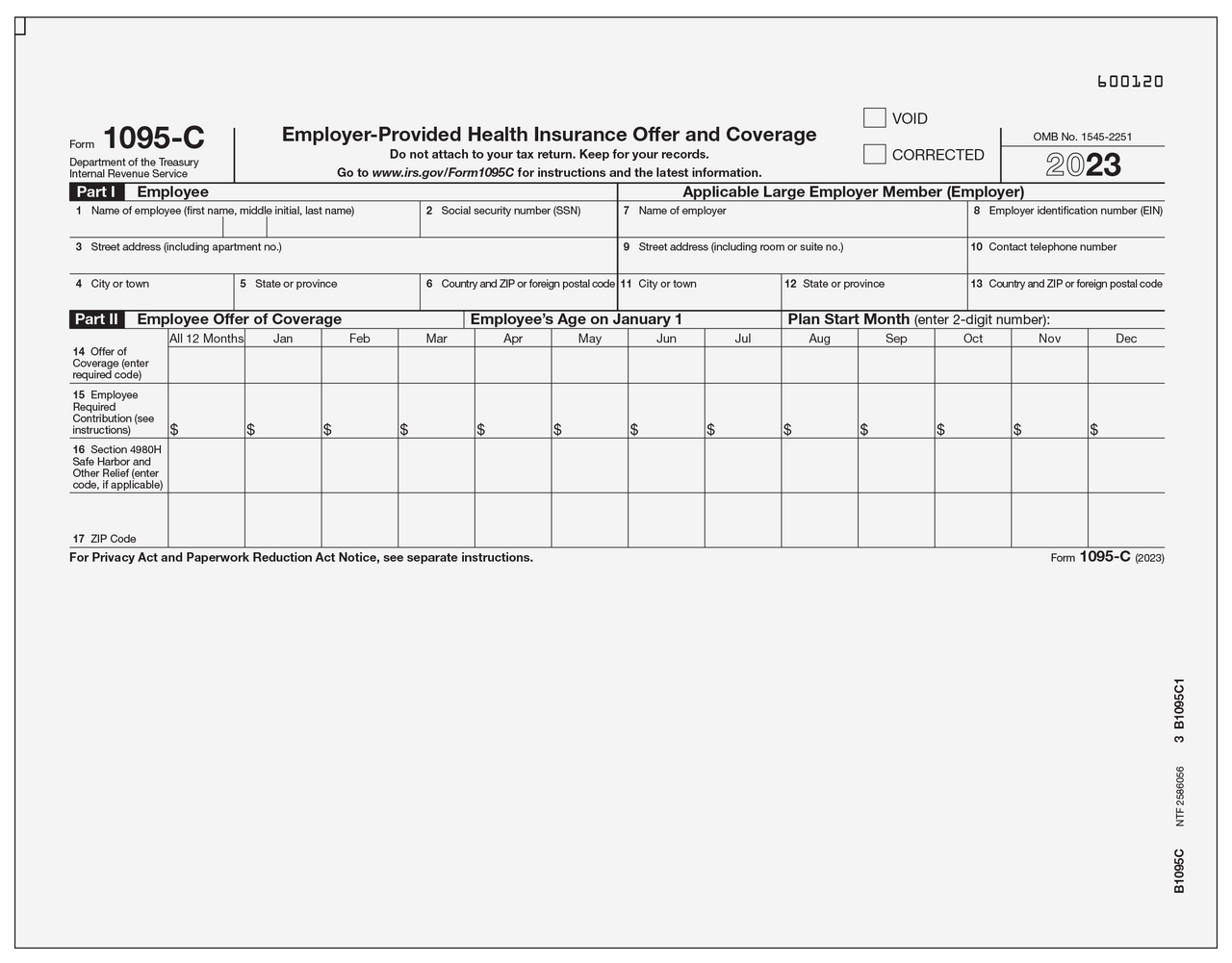

IRS Forms 1094 and 1095 are used for ACA reporting. Form 1094-B & C serves as a transmittal summary for multiple Forms 1095-B & C, while Forms 1095 provides details about the health coverage offered to individuals and employees.

Use CheckMark 1095 Software for the preparation and filing of 1094/1095 forms with the IRS. This software simplifies the otherwise complex process of reporting health coverage information for both individual and employee coverage.

ACA reporting obligations apply to applicable large employers (ALEs) with 50 or more full-time and full time equivalent (FTE) employees. This reporting includes providing employees with Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, and filing related forms with the IRS.

IRS Form 1094-B (Transmittal of Health Coverage Information Returns) is used by the filers (insurance companies or self-insured employers) as a transmittal form to accompany multiple 1095-B forms. The form provides information about the filer, including employer identification number, address, and contact details. It also includes the total number of 1095 forms accompanying the transmittal. Form 1094-B is sent only to the IRS, not to employees. For more information, refer to the instructions for Form 1094-B.

IRS Form 1095-B (Health Coverage) is used to report information about individuals who have Minimum Essential Coverage as per the Affordable Care Act (ACA). It provides information such as the healthcare coverage provider, the effective date of the coverage, covered months, and covered individuals. Form 1095-B should be filed with the IRS and a copy should be issued to the individuals. For more information, refer to the instructions for Form 1095-B.

IRS Form 1094-C, the Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns is a cover sheet accompanying multiple 1095-C forms. It is used by Applicable Large Employers (ALEs), which are employers with 50 or more full-time workers, including full-time equivalent workers. Importantly, Form 1094-C is sent solely to the IRS and not to employees.For more information, refer to the instructions for Form 1094-C.

IRS Form 1095-C (Employer-Provided Health Insurance Offer and Coverage) is used to report information about applicable employees who were offered health coverage by their Applicable Large Employers (ALEs). Form 1095-C should be filed with the IRS and a copy should be issued to the individuals.For more information, refer to the instructions for Form 1095-C.

Failing to meet the deadline for filing 1095 forms can lead to penalties. It's crucial to file on time to avoid financial consequences and ensure compliance with ACA reporting requirements. Penalties can vary from $60 to $630 per missed ACA form, depending on how late the forms are submitted. For more information, click here.

The ACA deadlines for the tax year 2024 are as follows:

IMPORTANT: *The deadline for furnishing ACA Forms 1095-B and 1095-C to individuals and employees respectively (March 01, 2025) falls on a Saturday, so the due date is delayed until the next business day, i.e., Monday, March 03, 2025.

As per the IRS, if you are filing 10 or more forms for the calendar year, electronic filing is mandatory. For less than 10 forms, you have the option to paper file and mail them to the IRS.

CheckMark 1095 Software makes electronic filing easy, streamlining the process to ensure accuracy and compliance with IRS guidelines.

To electronically file ACA forms with the IRS, you can use IRS-approved 1095 e-filing software, like CheckMark 1095 Software. Our software guides users through the necessary steps for electronic submission, simplifying the process and ensuring compliance with IRS regulations.

Before you can e-file, you must register to use IRS e-Services Tools and apply for your ACA Application for Transmitter Control Code (TCC). The IRS requires an ID.me account to access e-Services and other online services. For more information, refer to the Affordable Care Act Information Returns (AIR) guidelines from the IRS. Please note that the IRS may take up to 45 days to approve your application.

The IRS AIR (Affordable Care Act Information Returns) system is the electronic system (Modernized e-File (MeF) program) through which businesses and entities can electronically file their ACA information returns, including Forms 1094 and 1095. CheckMark 1095 Software generates manifest and form files in XML format, which can be easily submitted to the IRS AIR System.

The cost of filing 1095s can vary based on factors such as the size of your organization, the number of employees, and the features offered by the ACA software. CheckMark 1095 Software offers a clear and straightforward pricing structure, specifically designed to help small and medium-sized businesses efficiently meet ACA reporting requirements.

The starting cost for CheckMark 1095 Software is just $319. This includes a license for one company, as well as unlimited employees and ACA filings, with no hidden fees or unexpected costs. Whether you have 100 or 1,000 employees to file, the cost remains the same. If you need to manage more than one company, you can purchase additional company licenses for an affordable $30 each.

CheckMark 1095 Software does not store or save your ACA data. As our software is on-premises desktop software, all your ACA data is encrypted and stored locally on your computer. Only our software can open the ACA files on your computer, ensuring secure and safe access. We recommend keeping CheckMark 1095 Software, the operating system, and anti-virus software up-to-date to prevent unauthorized access.

CheckMark 1095 Software is frequently updated to incorporate any changes in ACA regulations and enhance the overall performance of the software.

Employers view the annual update as a minor expense considering the significance of accurately and efficiently reporting ACA compliance to the IRS. For a single, affordable annual fee, we continuously monitor changes in 1094/1095 B and C forms, and ACA regulations, to ensure our software is always up-to-date and compliant. Throughout the year, users can access free program patches for continuous support without any additional cost.

Yes, CheckMark 1095 Software provides a free demo version, allowing employers to explore its features and functionalities before making a purchase. This allows them to make informed decisions about their ACA reporting needs. Download the free demo now to experience the simplicity and accuracy of our ACA reporting software.

Yes, CheckMark 1095 Software includes features for generating corrections, allowing users to rectify any errors or omissions in previously filed 1094/1095 forms.

Desktop 1095 software designed and built for businesses of all sizes.

Download Demo Now